An indication of how the market values a company overall is its enterprise value (EV). Analysts created the term "enterprise value" to talk about a company's overall worth as an enterprise rather than just its market capitalization or market cap at the moment.

The market capitalization ratio expresses a publicly traded company's value as assessed by the stock market. The whole market value of all existing shares is represented by it. When comparing market capitalization to enterprise value, investors can have a more accurate understanding of a company's true worth.

Why does a company's market capitalization not accurately reflect its worth? First off, it omits a lot of crucial information, like debt and cash reserves held by the corporation. Since it takes cash and debt into account when valuing a company, enterprise value is essentially a modified version of market capitalization.

Comprehending Enterprise Value (EV)

To put it simply, EV is the total of a company's net debt and market capitalization. The EV is calculated by adding a company's market capitalization to its total debt, including both short- and long-term debt, and then deducting cash and cash equivalents.

The share price multiplied by the total number of outstanding shares is the market capitalization. As of February 18, 2022, Apple (AAPL) had 16.32 billion outstanding shares. At $167.30, its stock price is. Its market value is $2.7 trillion as a result.1.

This figure indicates the price at which each share of the company would need to be purchased. Therefore, market capitalization just shows the price tag of the company rather than providing you with its value.

Read also:

- How to Value Private Companies

- What Exactly Constitutes A Governance Framework

- What Is Enterprise Software Development

- The ArcOps: Connected enterprise architecture-operations pipeline

The Functions of Cash and Debt

When valuing a company, why are cash and debt taken into account? In the event that the company is sold to a new owner, the buyer is responsible for paying the debts of the company as well as the equity value, which is normally set higher than the market price. Cash must be subtracted because, of course, the buyer keeps the cash on hand with the company.

Consider a pair of firms with identical market capitalizations. On its balance sheet, one has no debt, whereas the other has a lot of debt. Over time, the heavily indebted corporation will have to make interest payments on its debt. Therefore, even though the market caps of the two companies are comparable, the company with greater debt would cost more to buy.

By the same token, consider two debt-free businesses with $250 million market valuations that are identical. One has $250 million in cash, while the other has minimal cash and cash equivalents (CCE). The enterprise value (EV) of the first company would be $250 million, whereas the EV of the second would be $0.

Ratios of Enterprise Value

To be honest, EV information by itself is not very helpful. Comparing EV to an indicator of a company's cash flow or earnings before interest and taxes (EBIT) can reveal additional information about the latter. Comparative ratios clearly show that enterprise value (EV) is a more useful metric for evaluating enterprises with different debt or cash levels, or, more accurately, different capital structures, than market capitalization.

EV assumes that, upon the acquisition of a company, its acquirer immediately pays debt and consumes cash, not accounting for interest costs or interest income. This is why it is crucial to utilize EBIT in the comparison ratio. Free cash flow (FCF), which aids in preventing additional accounting distortions, is even better.

Enterprise Value Ratio Example

Let's examine the prices of two fictitious stocks, Cramer Airlines and Air Macklon. Macklon's market capitalization was $13.5 billion at $45 per share, with a price-to-earnings (P/E) ratio of 10. However, its balance sheet carried a heavy net debt load of around $30 billion. Macklon's EBIT of $3.4 billion was less than 13 times its equity value (EV) of $43.5 billion.

In contrast, Air Macklon's P/E ratio was only 20, while Air Cramer's share price was $23 per share, with a market cap of $6.1 billion. However, Cramer had far less debt—its EV was $9.6 billion, its net debt was $3.5 billion, and its EV/EBIT ratio was under 10.

EV, which accounts for key factors including debt and cash levels, indicates that Cramer Airlines was valued significantly less per share than Air Macklon. The market eventually realized that Cramer was a better investment because it was more valuable for the money.

Read also: A Description of Small Business Based on Types of Small Businesses

What Is Meant by Enterprise Value (EV)?

The entire value of a firm is expressed as its enterprise value (EV). It can be viewed as a ballpark figure for the price of buying a business. A company's liquid assets and existing obligations are taken into consideration by EV. EV is frequently employed as a more thorough substitute for equity market capitalization.The total market value of a company's stock is known as equity market capitalization.

How Is Enterprise Value Determined?

Market capitalization plus the market value of debt minus cash and cash equivalents is the basic method for calculating enterprise value, or EV.

What Is The EV Ratio?

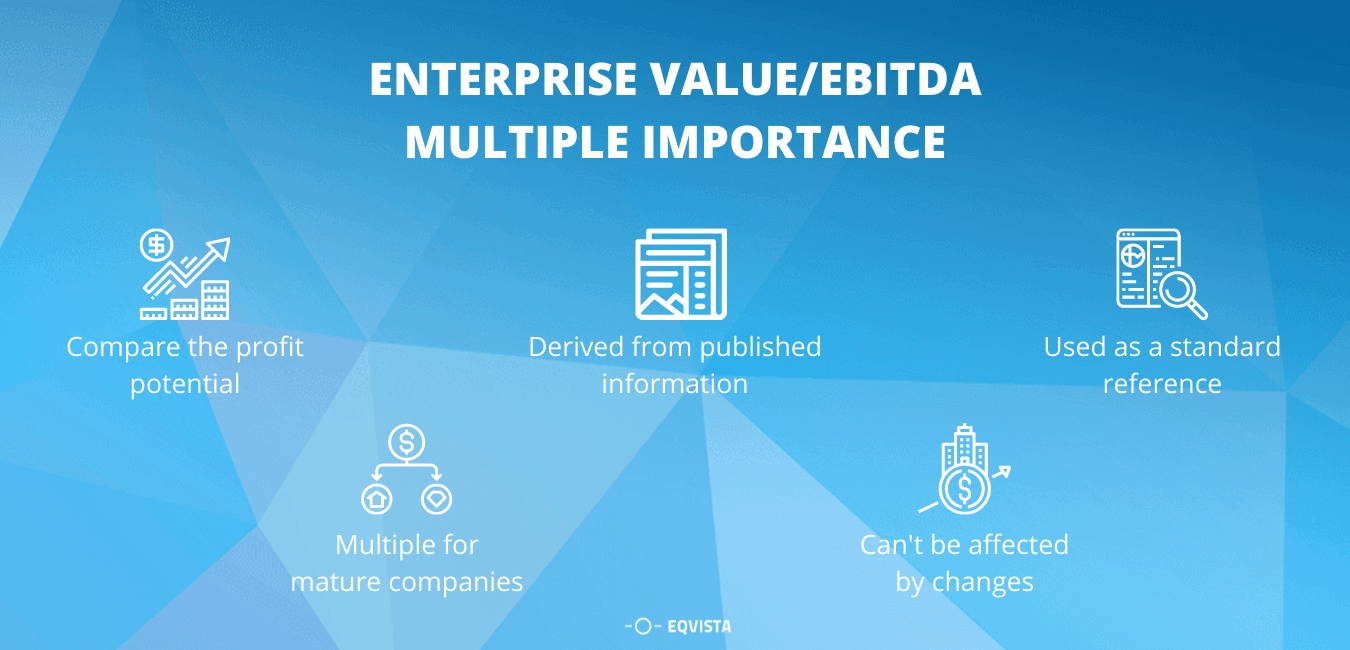

A company's EV is frequently used to compute other metrics or compared to other metrics. Operating income is split by the multiple enterprise value of the acquisition, for instance. A lower enterprise multiple would be a better deal than a greater enterprise multiple when comparing similar organizations. A popular valuation indicator for comparing the relative values of several businesses is the EV/EBITDA ratio.

What Is Indicated by a High Enterprise Value?

An estimate of the price that would be required to buy a company is reflected in the valuation concept known as enterprise value (EV). Let's say you want to compare two businesses in the same industry's enterprise values. If Company A's EV is significantly higher than Company B's, then Company A's anticipated purchase price is higher than Company B's.

Is book value and enterprise value the same thing?

A company's total worth is represented by a variety of indicators. The balance sheet of the company's financial statements determines the book value, which is the accounting value of the business. The market value and the stated values on the balance sheet, however, may fluctuate greatly. Due to the inclusion of debt and equity capital and its computation based on current market valuations, enterprise value (EV) is the most accurate measure of a company's overall worth. Moreover, embedded value is a statistic that is mostly utilized in Europe to evaluate life insurance firms.

The Final Word

The capacity of EV to evaluate businesses with various capital arrangements is what gives it its worth. Investors can determine if a firm is actually undervalued more accurately by examining enterprise value rather than market capitalization when determining a company's value.

Also read: What is a business enterprise?