If you’ve went through any time around startups, you’ve listened the express “We’re raising a round” hurled around like it’s a typical portion of life. For numerous originators nowadays, wander capital financing isn’t fair a money related apparatus.

It effectively shapes how companies develop, enlist, construct items, and indeed how they think. I’ve worked with early-stage originators who bootstrapped each dollar and others who raised millions some time recently propelling a item.

The contrast in mentality is genuine. Cash changes pace. It changes weight. And now and then, it changes the whole course of a startup. So let’s conversation truly around what wander capital subsidizing truly is, how it impacts new companies, and when it really makes sense.

What Is Venture Capital Funding, Really?

At its center, wander capital subsidizing is cash contributed in startups that have tall development potential. VCs don’t fair compose checks and vanish. They take value. They anticipate development. And in the long run, they anticipate an exit.

Read Also: Private Equity’s Growing Role in Startup Growth

Unlike a bank advance, authors don’t reimburse VC cash month to month. Instep, financial specialists wagered on the company getting to be enormous sufficient to make their offers profitable. That’s why VCs care less almost early benefits and more almost scale.

I once talked with a originator who said, “The minute we took VC cash, our startup halted being fair ours.” That stuck with me. Since it’s genuine.

How VC Money Changes Startup Growth?

The greatest move VC subsidizing brings is speed. With capital in the bank, new companies contract quicker, spend more on showcasing, and construct forcefully. That can be a tremendous advantage, particularly in competitive markets.

I’ve seen groups go from five individuals to fifty in beneath a year. Unused workplaces. Paid instruments. Enormous dispatches. All things that would’ve taken a long time without funding.

But speed cuts both ways. When development gets to be the primary metric, groups now and then transport speedier than they ought to. Choices get hurried. Item quality can slip. And originators feel weight to “look successful” instep of building something economical.

The Real Advantages of Venture Capital

There’s a reason founders chase VC money. When it works, it works well. One major advantage is access to experience. Good VCs don’t just bring cash. They bring connections, pattern recognition, and advice that can save founders from costly mistakes.

I’ve watched investors open doors to partnerships that startups couldn’t have accessed on their own. Introductions matter more than people admit.

Another benefit is risk tolerance. VC-backed startups can take bigger swings. They can try bold ideas without worrying about immediate revenue. That freedom can lead to real innovation.

When people ask about venture capital advantages and disadvantages, this upside is always the first thing mentioned for a reason.

The Downsides Founders Don’t Talk About Enough

Now for the uncomfortable part. Venture capital funding comes with expectations. High ones. Once investors are involved, growth targets aren’t optional. Miss them too often, and the pressure builds fast.

I’ve seen founders burn out trying to hit numbers that looked good in pitch decks but felt brutal in real life. There’s also dilution. Every funding round means giving up more ownership. Some founders wake up years later owning a surprisingly small piece of the company they started.

Control is another issue. Board seats, voting rights, and investor opinions can shape major decisions. Sometimes that’s helpful. Sometimes it leads to conflict.

VC money can amplify success, but it can also amplify stress.

Venture Capital vs Private Equity: A Clear Difference

People often lump these two together, but venture capital vs private equity is a very real distinction. Venture capital usually targets early-stage or fast-growing startups. The focus is future potential. Profits can come later.

Private equity, on the other hand, steps in when companies are more mature. PE firms often buy large stakes, cut costs, and optimize operations to increase profitability. In simple terms, VC builds rockets. Private equity fine-tunes engines.

I’ve seen startups thrive under VC but struggle once PE took over because the culture shifted overnight. Neither is bad. They just serve different goals.

How VC Funding Shapes Startup Culture?

This is something most articles skip, but it matters. VC-backed startups often develop a “growth at all costs” culture. Long hours. Big goals. Constant fundraising conversations. For some people, that environment is exciting.

You Must Also Like: Understanding Startup Funding Rounds Clearly

For others, it’s exhausting.

I’ve met founders who loved the adrenaline and others who quietly admitted they missed the early days when decisions were simpler. Money brings opportunity, but it also brings noise.

Company values get tested once investor expectations enter the room.

Is Venture Capital Always the Right Choice?

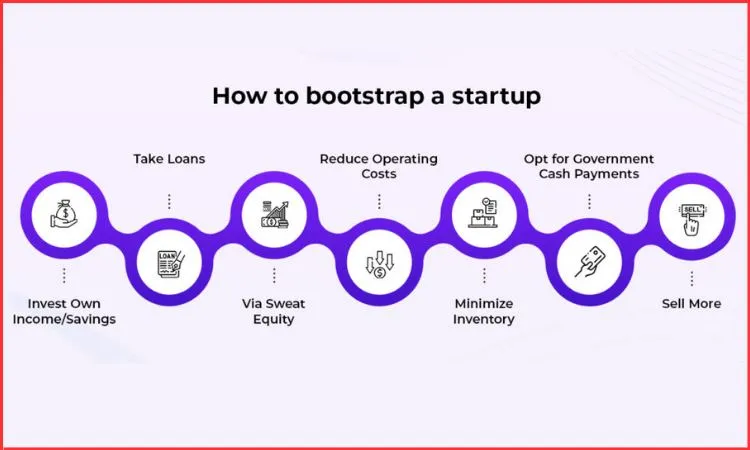

Not even close. Some businesses don’t need VC funding. Lifestyle businesses, niche products, and slow-growth companies often do better without outside pressure.

Bootstrapped founders keep full control and grow at their own pace. I’ve seen profitable companies built quietly without ever pitching a VC. They weren’t flashy, but they were stable and founder-friendly.

The real question isn’t “Can you raise VC?” It’s “Should you?”

If your business needs rapid scaling, heavy upfront investment, or market domination, venture capital might make sense. If not, it can become more burden than benefit.

What Smart Founders Think About Before Raising?

The best authors I’ve worked with inquired intense questions early. They thought around how much control they were willing to allow up. They considered how development weight would influence their group. They chose speculators carefully instep of chasing the most noteworthy valuation.

One originator told me, “I didn’t fair pitch my company. I met my investors.” That mentality makes a gigantic difference. Funding is a relationship, not fair a transaction.

How Venture Capital Is Shaping the Startup World Today?

Venture capital financing has changed what new businesses see like. It’s normalized quick scaling, worldwide desire, and gigantic subsidizing rounds. It’s moreover made a culture where victory regularly feels tied to gathering pledges or maybe than profitability.

That’s not all awful. Numerous world-changing companies wouldn’t exist without VC cash. But it’s worth recollecting that subsidizing is a device, not a goal. Startups succeed since they fathom genuine issues, not since they raised a enormous round.

Final Thoughts

Venture capital subsidizing can be transformative. It can offer assistance new businesses move quicker, think greater, and compete at a worldwide level. But it too reshapes needs, culture, and control in ways authors don’t continuously expect.

The most intelligent approach is an educated one. Get it what you’re marking up for. Learn the genuine wander capital points of interest and drawbacks. And select the way that fits your commerce, not fair the hype. Money powers development. Choices decide course.