Artificial intelligence (AI) has been one of the most smoking subjects in the tech world over the final few a long time, and the rise of Generative AI (GenAI) has as it were fueled the excitement.

In 2025, GenAI new businesses are pulling in enormous attention—and indeed greater speculation. But with valuations taking off, a key address is rising: Are these valuations sustainable?

As we see at the current state of AI subsidizing in 2025, it’s imperative to break down how we got here, where the cash is streaming, and whether or not these tall valuations will hold up in the long run.

The Rise of GenAI Startups

Generative AI, which alludes to AI advances that can make modern substance (like content, pictures, and music) from scratch, has detonated in ubiquity. Companies like OpenAI, Human-centered.

Soundness AI have made colossal strides in creating AI models that can create inventive substance at a scale and speed never seen some time recently. As a result, financial specialists have run to new businesses that are creating unused GenAI applications, whether it’s for trade, amusement, healthcare, or education.

Read Also: How To Value A Startup Before Funding

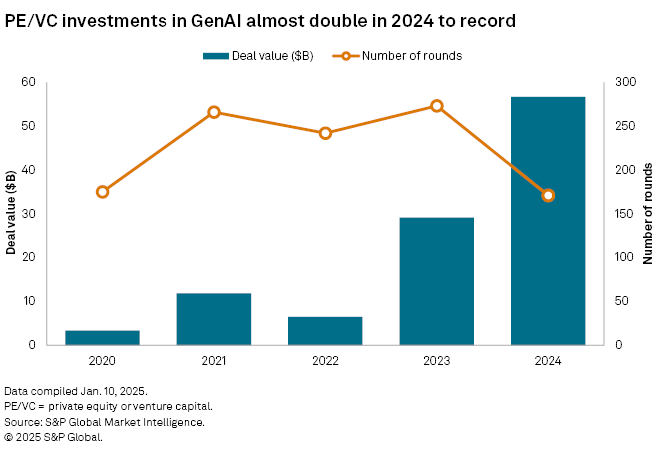

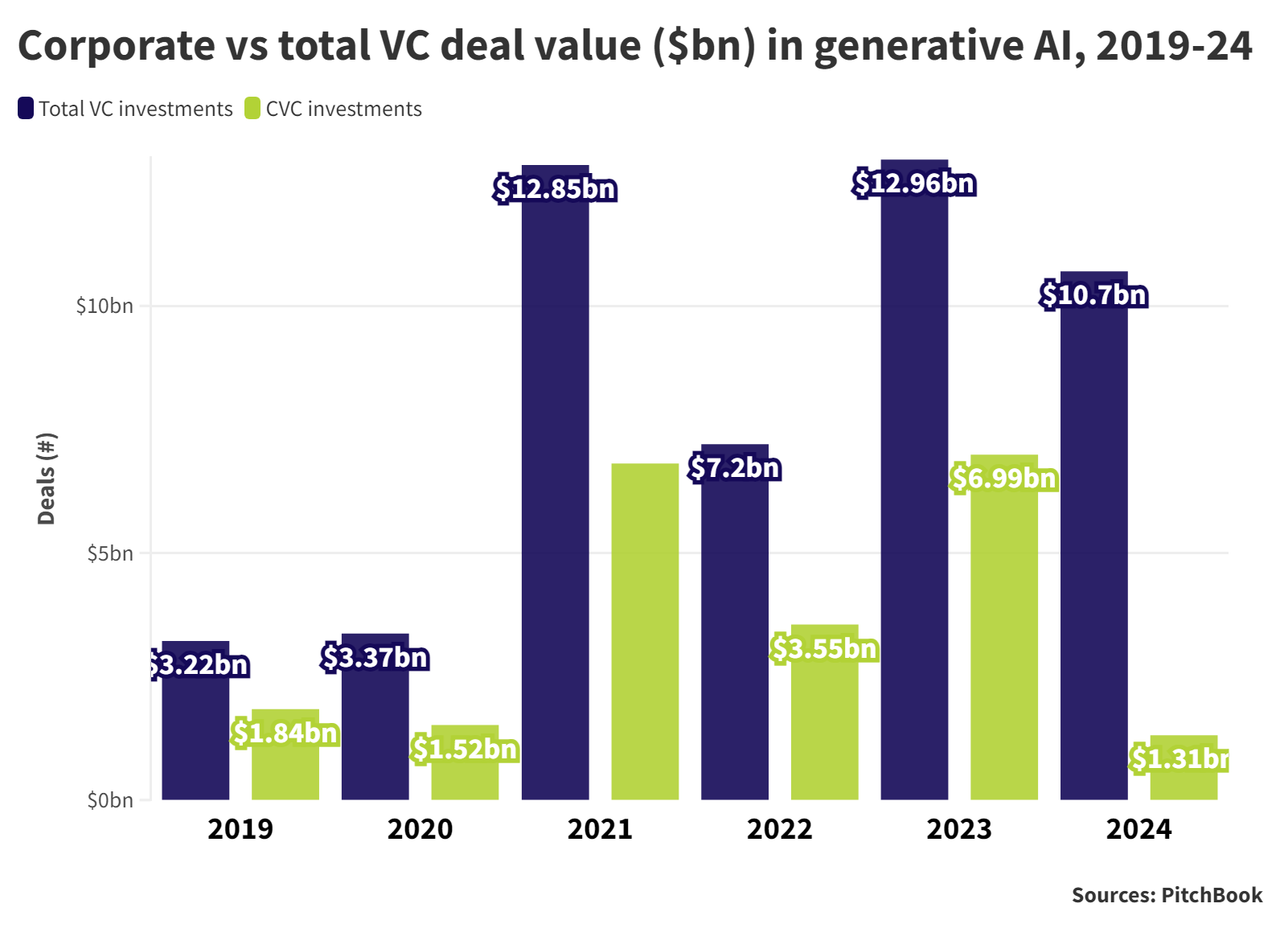

In 2023 and 2024, we saw record-breaking subsidizing rounds for GenAI companies. Numerous of these new companies raised millions, and in a few cases, billions of dollars, to proceed creating their models and growing their businesses. For occurrence, Solidness AI raised $101 million in Arrangement A financing, and Human-centered raised $580 million, among others.

Are Valuations Justified?

With all this venture, the enormous address on everyone’s intellect is whether the valuations of these GenAI new businesses are feasible. To get it this, let's break down a few imperative factors.

1. Showcase Potential and Demand

One of the reasons financial specialists are so enthusiastic to back GenAI new companies is the endless potential of the showcase. AI is being coordinates into nearly each industry, from making way better client benefit bots to creating modern shapes of excitement and planning cutting-edge restorative medicines.

GenAI models like GPT and DALL-E have appeared unimaginable guarantee in robotizing assignments that were once thought to be interestingly human.

For illustration, AI in Healthcare seem lead to speedier determination, personalized medicines, and indeed sedate disclosure. AI in Amusement is as of now changing how substance is made, with AI-generated craftsmanship and music getting to be more standard. This makes an gigantic request for GenAI devices, which drives up the advertise esteem of these startups.

As long as there’s proceeded request for inventive AI arrangements, the subsidizing and valuations are likely to stay solid. Financial specialists are wagering that GenAI will revolutionize businesses, and their good faith is driving the current tall valuations.

2. Development and Differentiation

Another reason for the tall valuations is the quick pace of advancement inside the GenAI space. Each month, modern models are being presented that thrust the boundaries of what AI can do. New businesses that offer special highlights or illuminate unused issues with AI are picking up consideration and funding.

You Must Also Like: Startup Exit Trends What I’ve Learned About the Future of Exits

However, not all AI new businesses are made rise to. A few new companies might be exaggerated since they don’t have a clear competitive edge or economical commerce demonstrate.

The advertise for AI apparatuses is getting to be swarmed, with numerous players advertising comparable arrangements, so it’s fundamental for new companies to proceed enhancing to legitimize their tall valuations.

3. Productivity and Income Models

Despite the buildup, numerous GenAI new businesses are still figuring out how to turn their groundbreaking innovation into productive businesses. In a few cases, these companies are not however creating critical income, depending instep on speculator subsidizing to keep going. This makes it difficult to survey the genuine esteem of these companies.

The address of supportability eventually depends on whether these new businesses can move from high-growth, high-risk companies to economical, beneficial ones.

Membership models, endeavor associations, and permitting are a few of the ways that GenAI new companies are attempting to produce income. But the challenge remains: can these income streams scale up in a way that bolsters their tall valuations?

The Hazard of Overvaluation

While the potential for AI is colossal, there are dangers to consider. A few specialists accept that the current valuations might be swelled, and that the showcase seem involvement a redress in the coming a long time. Here are a few reasons why that might happen:

Market Immersion: As more new businesses enter the GenAI space, competition will increment. With so numerous comparable instruments and models, it might gotten to be harder for person companies to stand out or pick up showcase share. This may lead to a descending alteration in valuations for new businesses that do not oversee to keep up a competitive advantage.

Regulation: AI is still a generally unused innovation, and governments around the world are beginning to present unused controls.

How will these controls influence the commerce models of GenAI new companies? Stricter rules on security, information utilization, and AI responsibility may lead to higher costs for these companies or indeed constrain their potential.

Technology Buildup: There’s continuously a peril in the tech world of overhyping a modern innovation. Whereas GenAI is unimaginably effective, it’s still a long way from being idealize.

We may confront unexpected restrictions or challenges that might cause a move in speculator assumption. If the advertise loses certainty in the innovation or if the development direction moderates down, valuations may take a hit.

What Does This Cruel for Investors?

For financial specialists, the key is to be cautious. Whereas the potential for AI development is energizing, it's imperative to take a step back and evaluate the essentials of each startup.

Feasible development, clear trade models, and showcase separation will be the key components in deciding whether a GenAI startup’s valuation is justified.

As we move through 2025 and past, we may see a few alterations in valuations, particularly if certain new companies come up short to live up to their grand desires. On the flip side, the right ventures in new companies with solid administration, imaginative items, and clear ways to productivity seem abdicate noteworthy returns.

The Street Ahead for GenAI Startups

Looking ahead, the future of GenAI new businesses will depend on a few key factors:

Continued development: New businesses that keep pushing the boundaries of what AI can do will be in a superior position to maintain tall valuations.

Business maintainability: Finding ways to produce relentless income and demonstrate productivity will be significant for long-term success.

Industry organizations: Collaborating with bigger companies and shaping key associations might offer assistance new companies scale quicker and pick up credibility.

While the current boom in AI subsidizing is energizing, it's fundamental to approach it with a solid measurements of authenticity. Tall valuations are not ensured to final until the end of time, and speculators and authors alike ought to keep an eye on the advertise to guarantee they’re making feasible decisions.

As the innovation develops and the commerce models cement, we’ll have a clearer picture of which GenAI new businesses are built to last—and which ones might battle to keep up their current valuations.

Conclusion

In 2025, the state of AI financing is still exceptionally much a "hold up and see" circumstance. The potential for GenAI to change businesses is genuine, but the tall valuations of numerous new businesses might not be economical in the long run.

As competition increments and administrative challenges emerge, as it were the most imaginative and fiscally sound GenAI companies will be able to flourish. For financial specialists, the key will be to carefully evaluate which new companies have the best chance of adjusting to these changes and conveying enduring esteem.