In most cases, carried interest is eligible for taxation as a long-term capital gain, which is taxed at a rate that is lower than the rate that applies to ordinary income. Carried interest typically is only paid if a fund achieves a specified minimum return. Because carried interest is typically distributed after a period of years, it defers taxes in the manner of an unrealized capital gain.

What Is Carried Interest?

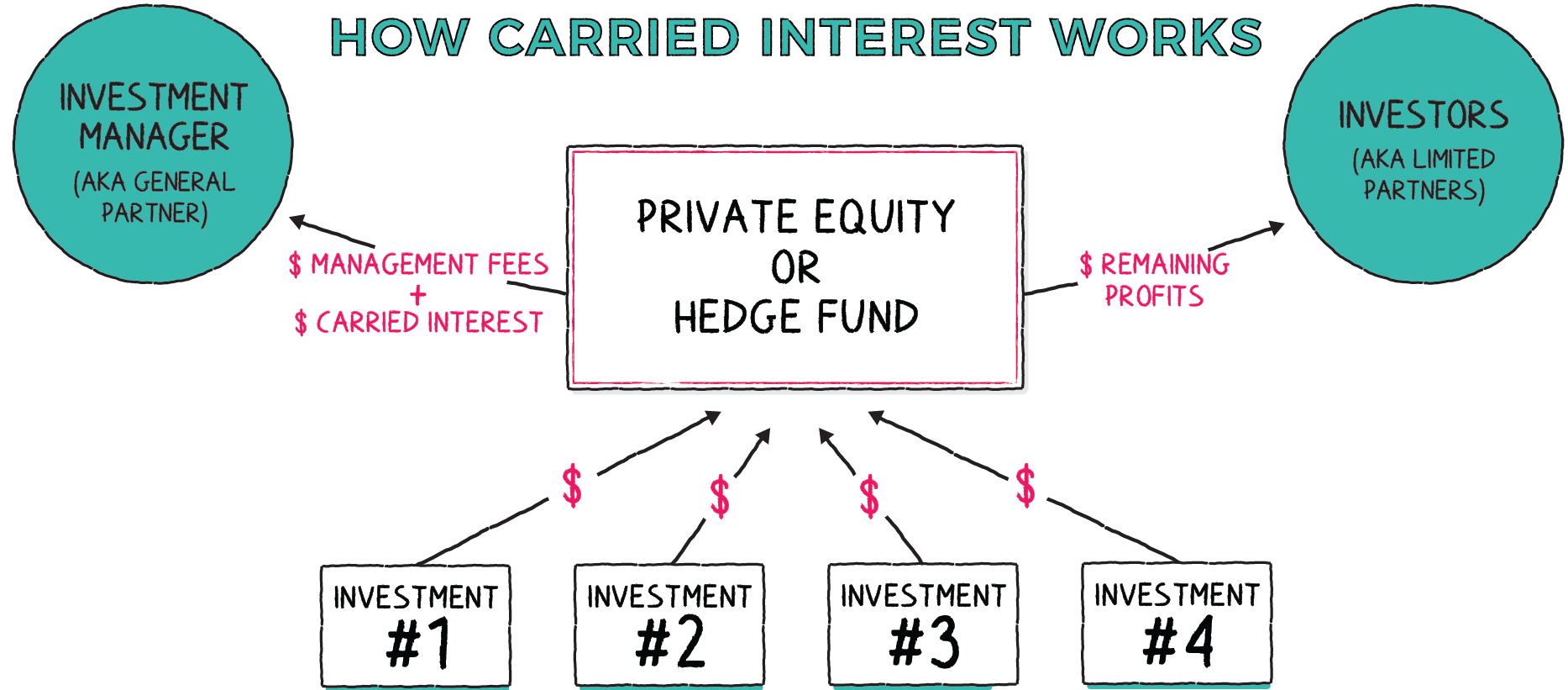

The term "carried interest" refers to a portion of the earnings that are contributed by general partners in hedge funds, private equity, and venture capital firms. As opposed to making an initial investment in the fund, general partners are entitled to carried interest because of the position that they play in the fund. The pay of the general partner is aligned with the returns of the fund via the use of carried interest, which is a performance fee.1.Most of the time, carried interest is only paid out if the fund reaches a certain minimum return, which is referred to as the hurdle rate.In most cases, carried interest is eligible for taxation as a long-term capital gain, which is taxed at a rate that is lower than the rate that applies to ordinary income.

Recommended to read:

- Funding in Series A, B, and C: What Is It?

- How to Make Funds for Your Start-Up Business Idea

- 5 Basis for Strategic Partnerships in Your Company

How Carried Interest Works

Usually representing twenty percent of a fund's profits, carried interest is the general partner's main source of income. Gains are transferred by the general partner to the fund's management.

A 2% yearly management fee is another price that many general partners levy.1.Carry interest is only paid out if a fund meets a certain minimum return, in contrast to the management fee.2.

In addition, carried interest may be lost if the fund underperforms.The limited partners in the fund may be entitled, in accordance with the terms of their investment agreement, to "claw back" a portion of the carry paid to the general partner in order to make up the difference when the fund closes, for instance, if the fund intended to return 10% annually but only returned 7% for a while. The clawback clause has been used to support the claim that carried interest should not be subject to ordinary income taxation, despite the fact that it is not industry standard.

Taxation of Carried Interest

Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20%, compared with the 37% top rate on ordinary income.45

Critics argue taxing carried interest as long-term capital gains allows some of the richest Americans to unfairly defer and lower taxes on the bulk of their income.6

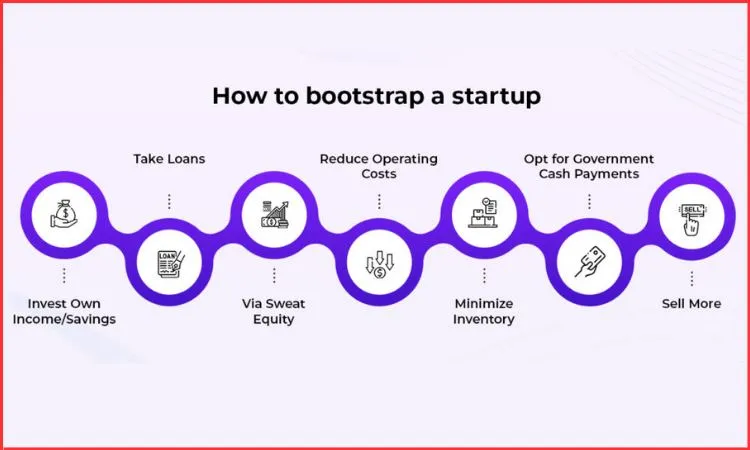

Defenders of the status quo contend the tax code's treatment of carried interest is comparable to its handling of "sweat equity" business investments.1

The minimum holding period on an investment required to qualify associated carried interest for treatment as a long-term capital gain was increased from one year to three by the 2017 Tax Cuts and Jobs Act.7 The Internal Revenue Service (IRS) issued complex rules related to the provision in 2021.8

Private-equity and venture-capital fund holding periods typically range from five to seven years, however.9 Some in Congress have proposed requiring the annual reporting of imputed carried interest for immediate taxation as ordinary income.

Read also: TEXAS'S TOP 10 ANGEL INVESTORS IN HOUSTON