I still keep in mind the to begin with time I sat down with a whiteboard and attempted to sketch out startup funding strategies for my claim trade thought. I had enormous dreams and exceptionally small cash. What I didn’t realize at that point was how numerous ways there are to getting cash — and how choosing the right one can make or break your company.

Raising funds isn’t fair about finding investors. It’s approximately understanding the scene, knowing your needs, and picking the right minute to act. A originator who knows how to secure funding for a startup doesn’t fair survive — they thrive.

Let’s walk through the most viable approaches I’ve seen work for authors over the a long time. These are the techniques worth knowing, attempted and tried by individuals who’ve burned botches so you don’t have to.

Know Your Why Before You Ask for Money

Before you start searching for funding, take a moment to define what you’re actually trying to achieve. Do you need a little capital to build a prototype? Or do you need a big round to scale internationally?

Read Also: Emerging Startups to Watch This Year | Top New Companies

Every dollar you raise has purpose. The clearer you are about that, the easier it is to pitch it to others. I’ve coached founders who started fundraising with a vague goal like “grow faster.” That always faltered. But those who said “we need $200K to finish product development by Q3” got meetings fast.

Investors don’t fund dreams. They fund plans they can understand.

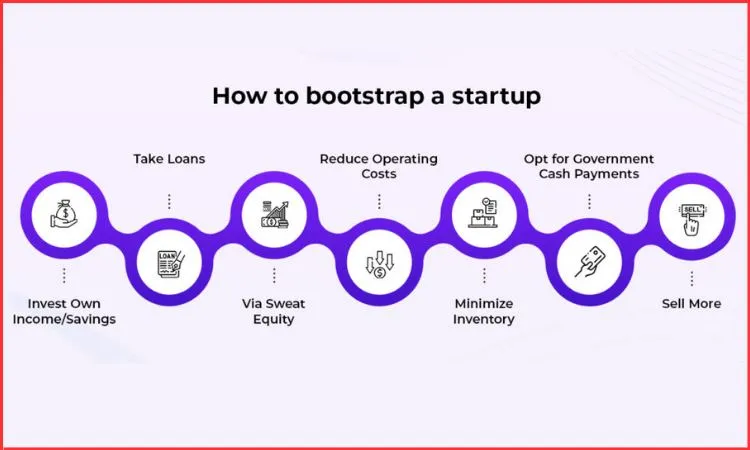

Bootstrapping: The Most Underrated Startup Funding Approach

Bootstrapping means building your startup with your own money or early revenue. It’s not glamorous. But it gives you enormous control. When you fund your early stages yourself, you don’t dilute ownership.

You don’t owe answers to investors. You build real traction before asking for outside capital. That matters. I’ve seen founders build solid businesses without a dime from angels.

One friend survived the first 18 months purely on early customer revenue and part‑time consulting. By the time she raised her first round, she already had paying users. That made fundraising almost easy.

Bootstrapping isn’t right for every business, but it’s worth trying before you look outward.

Angel Investors: Friendly Money With Experience Attached

Angel investors are individuals who invest their own money in startups. They usually come in early, when risk is high and funding is low. What makes angels valuable isn’t just capital — it’s experience.

Good angels mentor. They introduce you to future investors. They open doors. I once worked with a founder who secured an angel investor mainly because they shared a mutual contact.

That investor did more than fund the business — they helped shape the pitch deck and refine product strategy. Angel rounds don’t have to be huge. But picked wisely, they set you up for bigger investments later.

Venture Capital: Go Big or Go Home?

Venture capital is often what founders picture when they think of funding.

VCs write big checks. They bring credibility and support. But they also expect major growth — fast.

VC money makes sense if your business can scale rapidly and needs capital to do it.

I’ve seen startups pivot dozens of times before settling on a product‑market fit. VCs didn’t love those pivot cycles. But companies with a validated model and rising revenue? They made VCs very happy.

One thing to keep in mind: VCs don’t just invest in ideas. They invest in teams, markets, revenue potential, and exit possibilities. Come with data. Come with early traction. And come with a plan beyond just raising capital.

Startup Fundraising Platforms: Modern Tools for Modern Founders

Crowdfunding and online startup raising money stages have changed the game. They let you reach a wide gathering of people instep of asking for intros one financial specialist at a time.

Platforms like Republic, WeFunder, and Seed Invest let ordinary individuals contribute nearby proficient backers. What I like almost these stages is their straightforwardness.

You appear your story, early numbers, and objectives. Individuals select to back you. That perceivability can pull in press, clients, and future investors.

For buyer items and community‑focused new businesses, this approach can be capable. But it requests fabulous narrating. You have to interface candidly with your group of onlookers, not fair toss numbers at them.

Grants and Competitions: Non‑Dilutive Financing You Shouldn’t Ignore

Not each financing technique strengths you to donate up equity. Grants, development grants, and pitch competitions provide you cash without giving absent ownership.

I’ve seen new businesses win $50K from territorial tech committees fair by entering a clean, fair pitch competition. The work you put into the application frequently hones your commerce account too.

You Must Also Like: Business Startup Ideas for Students and Young Entrepreneurs

These openings aren’t boundless, and they don’t supplant wander capital. But they can purchase time, construct validity, and fill holes in early runway without dilution. Check government programs, neighborhood hatcheries, and specialty industry stores. You might be shocked what’s available.

Strategic Organizations and Corporate Investors

Some of the best early financing can come from companies who advantage from what you’re building. Strategic accomplices contribute since your victory makes a difference theirs. This might be item conveyance, innovation integration, or get to modern markets.

I keep in mind a originator who collaborated with a coordination company. They gave starting financing in trade for need get to to unused highlights and a income share.

It’s not for each startup, but if your item compliments a bigger player’s offerings, this approach can open both cash and showcase reach.

Friends and Family Rounds: Handle With Care

This is one of the most common early paths — and also one of the most delicate.

Raising money from people close to you can give you runway when other sources won’t bite yet.

But it mixes business with personal relationships.

I tell founders to treat these funds seriously:

-

Document terms

-

Set clear expectations

-

Avoid vague promises

You don’t want relationship stress on top of startup stress. Handled professionally, friends and family rounds can be a solid start. Handled loosely, they can become a mess.

How to Pitch Without Sounding Like Every Other Founder?

Every founder needs to answer the same core question: Why should someone invest in you? And the best way to answer that is by showing tangible momentum:

-

Early revenue

-

Growing user base

-

Repeat customers

-

Positive market feedback

Numbers matter. Stories matter even more.

I always tell founders: investors back people they believe will win. A clear story backed by data wins more often than complex models with no traction. Your pitch is not a script to memorize. It’s a story to own.

Tracking Progress: Key Metrics Investors Actually Care About

Investors see a lot of slides. Most of them repeat the same vague metrics. What really gets attention are things like:

-

Customer acquisition cost

-

Lifetime value

-

Monthly recurring revenue

-

Growth rate month over month

A founder who can walk into a room and say, “Here’s our revenue pattern for the last six months,” already has an edge.

Don’t chase fancy metrics. Track what reflects real business health. That’s how you build credibility fast.

Timing Matters More Than You Think

I’ve seen founders start fundraising too early and get ignored. I’ve also seen founders wait too long and expend runway avoiding investors. There’s a sweet spot. Raise before you desperately need cash. But don’t raise before you have traction worth showing.

If you go in with a deck that says “We’re about to launch,” you’ll hear “Come back when you have users.” But if your deck says “We launched, users love it, and we’re growing,” doors open. That momentum is one of the most powerful startup funding strategies available.

What I Wish I Knew Before My First Raise?

When I first tried raising money, I thought the goal was to get funded. I was wrong. The real goal is to prove your business matters. Funding is a byproduct of clarity, traction, and belief in what you’re building.

Money accelerates. It doesn’t validate. If you start with that mindset, every conversation — with angels, VCs, platforms, partners, or even customers — becomes part of improving your business.

And that’s worth learning early.